Data you can trust for private equity growth

Maximize returns, streamline M&A, and manage portfolio risk with a data management platform tailored for private equity. Unify, analyze, and govern PE data to make informed decisions about deals and uncover new growth opportunities.

Maximize portfolio value with data-driven insights

Private equity firms rely on trusted data to optimize portfolio performance, execute seamless M&A processes, and manage compliance. Our platform delivers actionable insights, reduces inefficiencies, and drives measurable ROI.

Turn portfolio data into measurable outcomes

Unify and standardize financial and operational data across investments. Benchmark trends, analyze performance, and identify growth opportunities to improve portfolio returns.

Accelerate M&A with integrated data

Streamline pre-and-post-deal processes with trusted, integrated data. Simplify due diligence, onboard new assets efficiently, and ensure seamless operational integration.

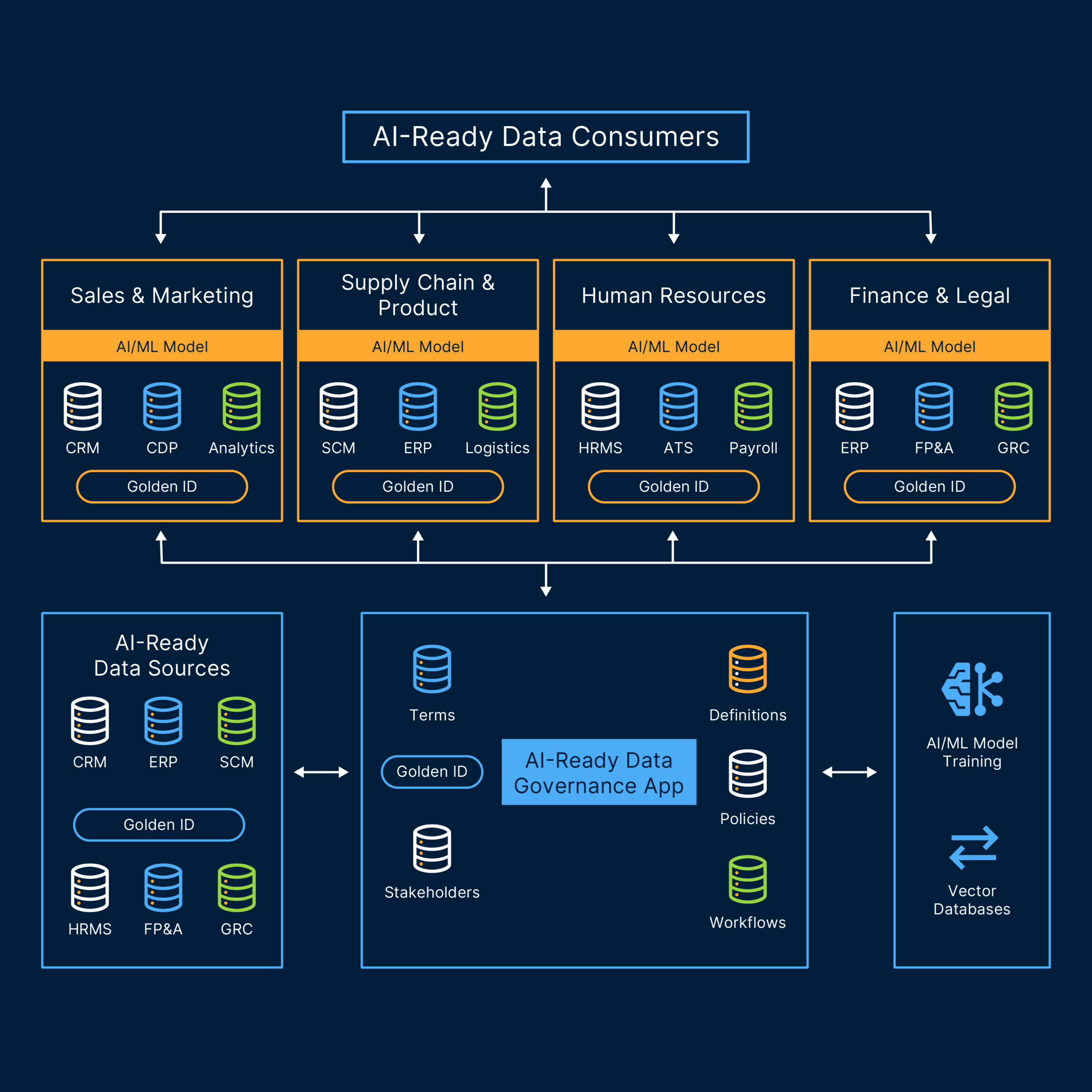

Enforce automated data governance

Increase data quality standards with automated workflows and real-time monitoring. Gain transparency into your portfolio data while meeting regulatory compliance and simplifying audits.

Manage and mitigate risk proactively

Use real-time data insights to reduce exposure and protect portfolio performance. Identify risks, track compliance, and build strategies to safeguard investments.

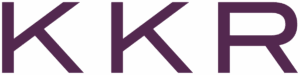

Simplify complex financial hierarchies for smarter investments

Manage financial hierarchies across portfolio companies, legal entities, and funds with streamlined regulatory reporting and global visibility. Reduce complex ownership structures and support M&A with intelligent data.

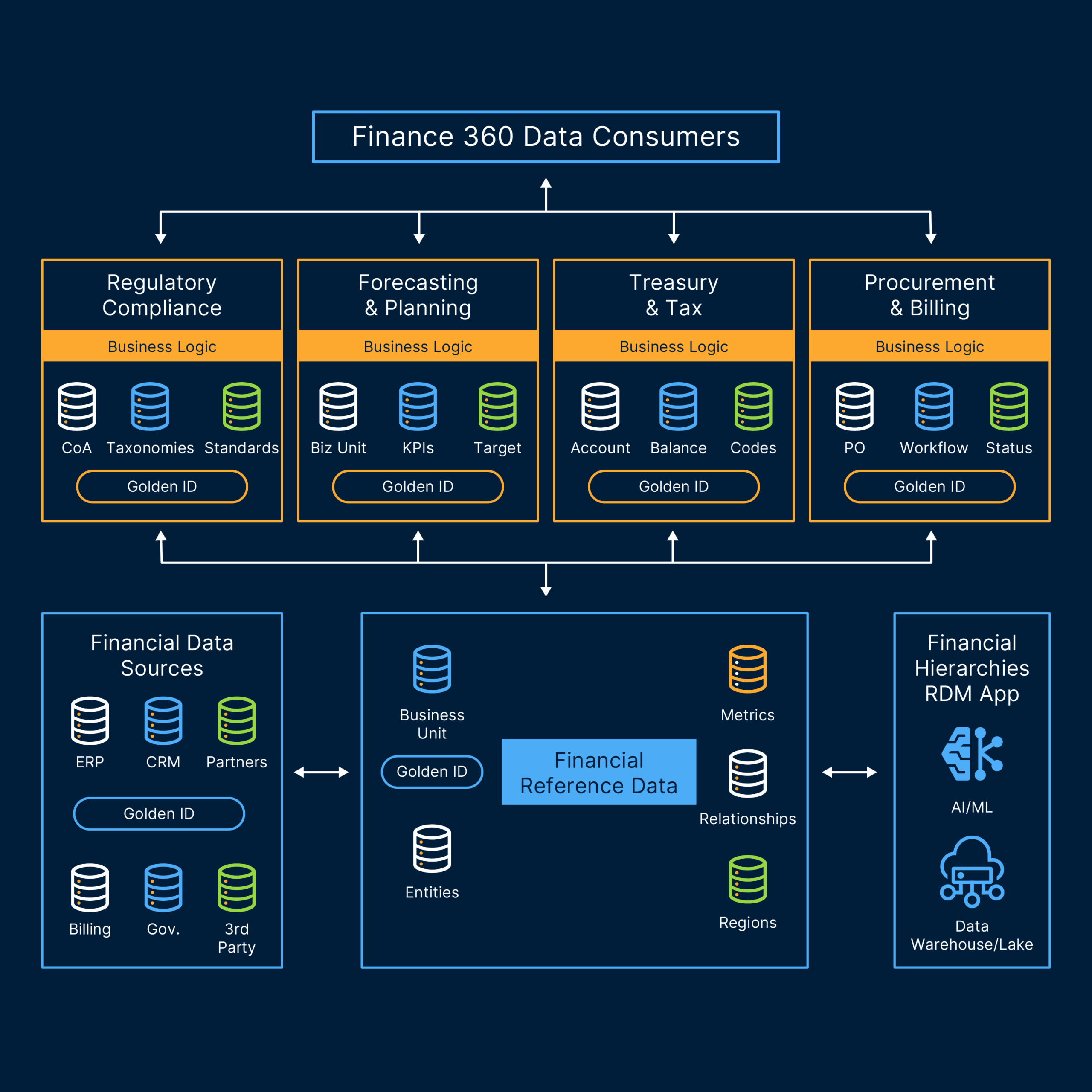

Get a 360° view of legal entities and investors

Unify data from disparate systems into trusted profiles for portfolio companies, fund managers, and investors. Enable personalized engagement, improve fund management, and streamline operational oversight.

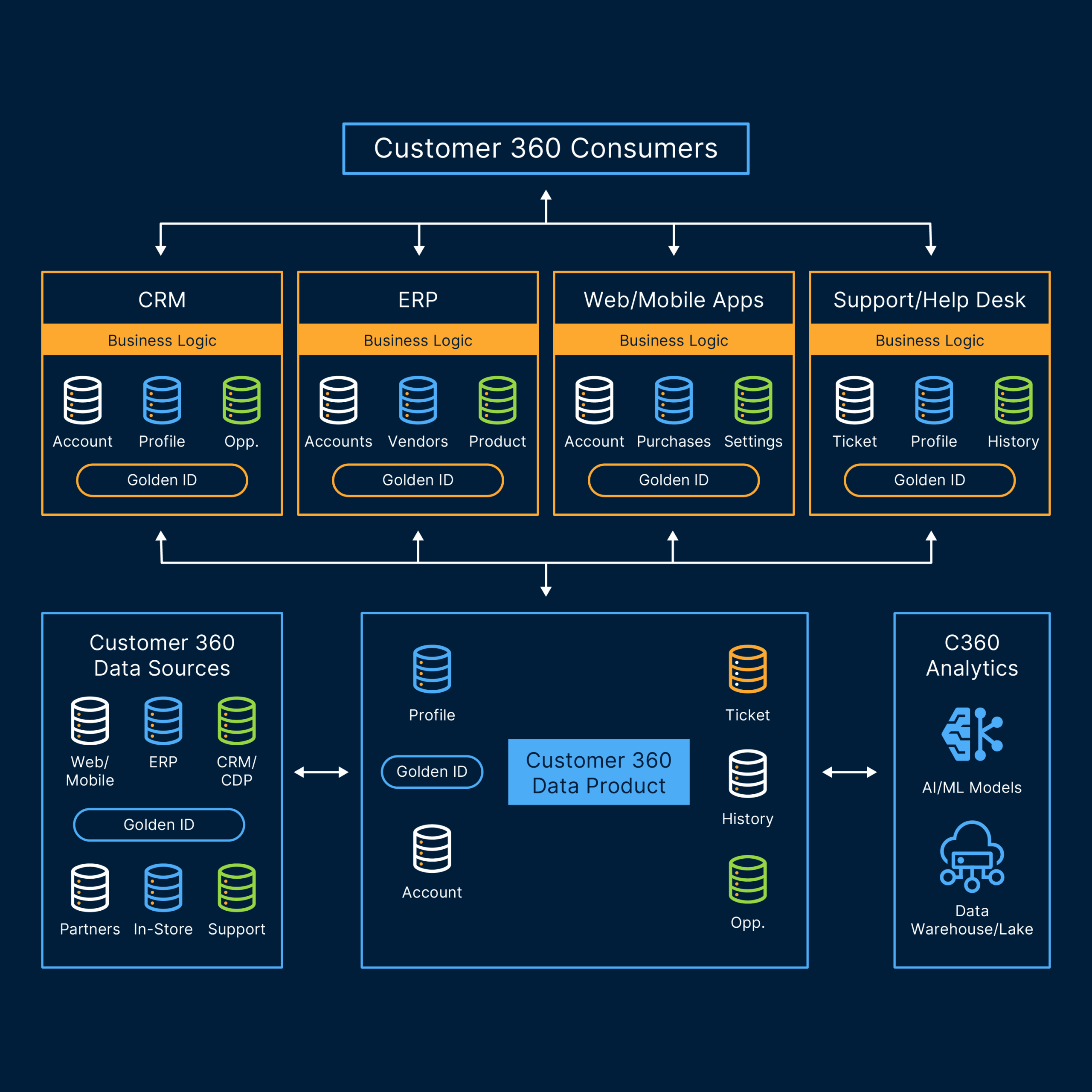

Drive business transformation across portfolios

Support portfolio growth and transformation by unifying financial and operational data. Enable quick adaptation to restructuring, new business models, or scaling operations with clean, connected insights.

Build scalable AI-ready data for predictive insights

Power forecasting and risk modeling with clean, accurate data optimized for AI. Automate enrichment, reduce errors and deliver predictive insights to drive smarter decisions in fund management and portfolio performance.

Pre-built private equity accelerators for quick deployment

Get a head start on managing your data with Semarchy’s pre-built accelerators for the private equity industry. These ready-to-deploy models allow you to integrate and analyze data almost immediately with no development teams needed.

Trusted by enterprise data leaders around the world

Our private equity customers value the rapid deployment of the Semarchy Data Platform, the dedicated support from our success team, and the ability to streamline operations, improve decision-making, and drive portfolio growth.

2024 Gartner® Market Guide for MDM Solutions

Semarchy is recognized as a Representative Vendor. Discover why industry leaders trust us to lead their MDM strategy.

See whyConsolidated master records managed

We’ve successfully handled complex data initiatives across a range of industries and domains.

See our impact

SoftwareReview Emotional Footprint Awards

Semarchy received the highest possible ranking from users, with a +94 Net Emotional Footprint.

Learn moreReady to master your private equity data?

Semarchy is your partner in private equity innovation. From identifying potential risks to centralizing legal entity data, we can help you achieve ROI in less than 12 weeks with a fully functioning unified data platform.