By Scott Moore, Director of Presales, Semarchy

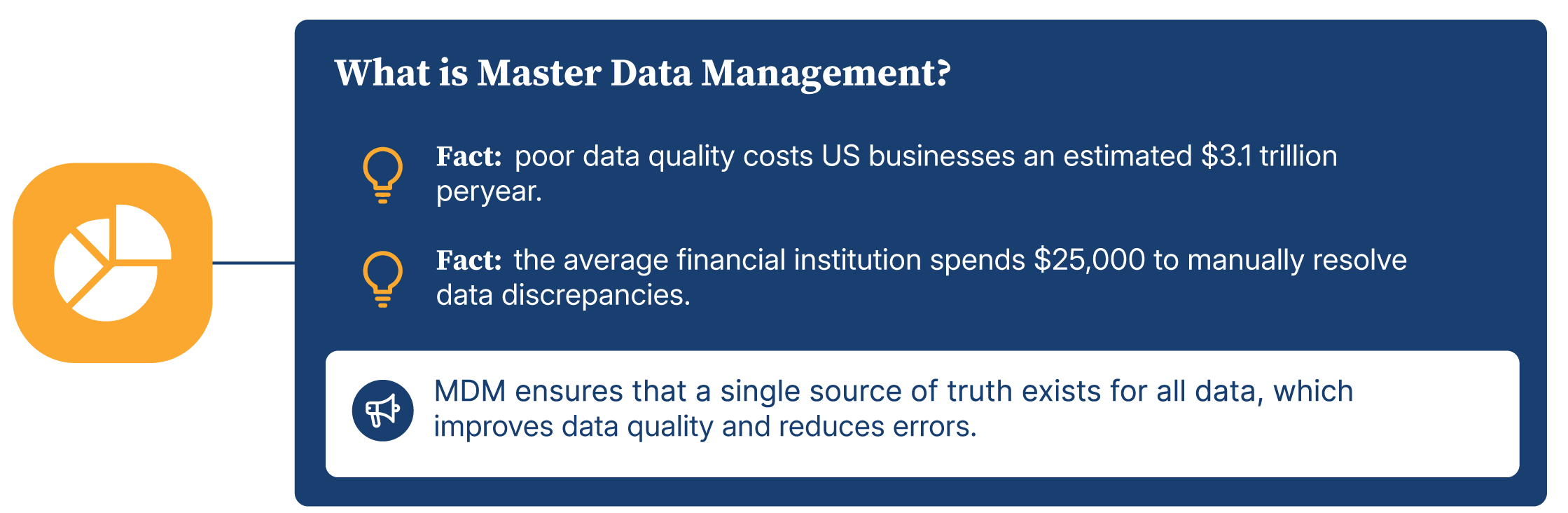

By its very nature, the financial services sector stands out as one of the most data-intensive industries. Therefore, Master Data Management (MDM) solutions offer exceptional potential to process, analyze, and leverage finance master data for valuable insights and actionable outcomes.

Source: Data as currency in finance

Source: Data as currency in finance

A recent blog post here on the blog examined the specialties of doing Master Data Management (MDM) in manufacturing and using manufacturing data management software. The post was called 4 Key Aspects of Master Data Management in Manufacturing.

The capabilities of finance data management software range from identifying new revenue opportunities to streamlining regulatory compliance and optimizing the customer experience. In this post, we’ll examine two aspects unique to Master Data Management for financial services – the impact of regulations and data domains.

The Impact of Regulations on Finance Master Data Management

The intense regulatory pressure placed on the financial sector amplifies the risks associated with poor or mismanaged data significantly. Any breaches or violations can lead to severe consequences and penalties.

The regulations aim at improving market confidence, financial stability, and consumer protection which stretch across concepts such as Know Your Customer (KYC), Anti Money Laundering (AML), and many more. Executing financial Master Data Management revolves around adhering to these regulations and the embedded concepts.

The increased use of technology for data collection and analysis has resulted in regulatory bodies demanding increasingly more granular data to bolster supervisory, risk assessment, and stress testing efforts. Reporting requirements have become progressively more data-intensive under every major financial regulation, requiring banking institutions to manage, clean, and analyze vast volumes of information to mitigate risk, perform analytics, and conduct stress testing.

The risks and rewards associated with data collection are immense, but fortunately both can be steadied with the right MDM software. When implementing a financial Master Data Management solution, you will need a broad set of capabilities that cover:

-

- the traditional goals of managing master data, for example getting a Single Customer View (SCV)

-

- the specifics of what is entailed in and demanded for Knowing Your Customer (KYC)

Like any successful data strategy, proper finance MDM requires careful consideration and planning.

Read our blog: 7 Steps to scope out your Master Data Management requirements to help you select an MDM system that will fit your identified requirements, scope, and context.

Data Domains in Focus

At the core of Master Data Management are data domains – specific categories of data critical to your operations. In MDM we often focus on three major data domains: Customer master data (which can be managed using a customer master data management software), supplier master data, and product master data (which can be managed using a product master data management software). These domains are also relevant for Master Data Management in financial services, however, often with a different meaning, naming, and additions.

To establish which data needs to be managed, you must first determine which domains are the most critical to master, how they impact your organization, and the potential risks for not managing it. Thereafter, as part of your finance MDM strategy, you must generate an inventory of all your existing data sources and determine which ones to consolidate. It’s easier to create a central repository and apply good data hygiene if there are less systems to keep track of.

With the right finance Master Data Management strategy, you’ll have comprehensive information on all locations and assets at your fingertips, so you can connect functions and teams to improve performance and business continuity.

The customer is king in any business. In financial services, a customer is often regarded as one of several different party roles that are involved in business processes. The customer can be one of many counterparties involved in transactions taking place. Therefore, we see the party domain being more naturally accepted by business stakeholders in financial services than we tend to see in other industries.

From Finance Master Data Management to Data Hub Strategy

The requirements for Master Data Management in the financial services sector early in the journey lead to solutions that must be able to encompass Extended Master Data Management. This can also be seen as a data hub strategy where data quality and data governance play a crucial role.

To power a digital platform with data, leverage machine learning capabilities, ensure the integrity and consistency of duplicated data, gain deeper customer insights, and deliver context-aware services, the data hub architecture is the optimal choice.

You can learn more about these considerations in a webinar co-hosted by Semarchy with participants from Sumitomo, HSBC, and Bloomberg discussing data quality and governance in How to establish data quality and data governance for analytics in financial services.

Share this post